Starting a business is an exciting journey, but it can also be overwhelming. One of the most critical decisions you'll make is choosing the right business structure. This choice can significantly impact your tax obligations, liability protection, and overall business operations. In this article, we'll guide you through the process of selecting the right business structure, focusing on LLCs and other common entities. Let's dive in!

Understanding Business Structures

What is a Business Structure?

A business structure defines the legal and operational framework of your company. It determines how your business is taxed, how profits and losses are distributed, and the level of liability protection you have. Choosing the right structure is like selecting the right foundation for a building—it sets the stage for your business's future growth and stability.

Common Business Structures

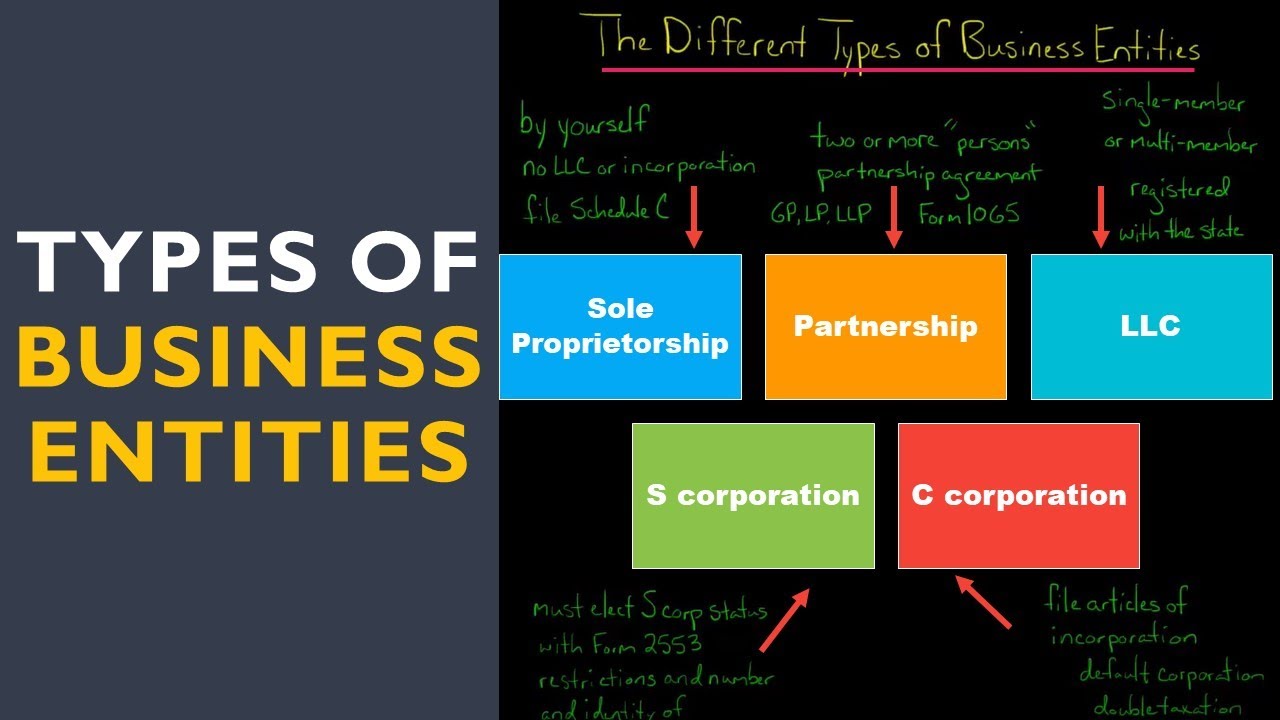

Sole Proprietorship

- Definition: A business owned and operated by a single individual.

- Pros: Easy to set up, minimal paperwork.

- Cons: Unlimited personal liability, higher tax rates.

Partnership

- Definition: A business owned by two or more individuals.

- Pros: Shared responsibilities, combined resources.

- Cons: Joint liability, potential disagreements.

Limited Liability Company (LLC)

- Definition: A hybrid structure that combines elements of corporations and partnerships.

- Pros: Limited liability protection, flexible management, pass-through taxation.

- Cons: More complex than sole proprietorships, potential self-employment taxes.

Corporation

- Definition: A separate legal entity owned by shareholders.

- Pros: Strong liability protection, ability to raise capital.

- Cons: Double taxation, complex regulations.

Why Choose an LLC?

Liability Protection

One of the primary reasons entrepreneurs choose an LLC is the liability protection it offers. In an LLC, your personal assets are separate from your business assets. This means that if your business faces legal issues or debts, your personal assets are generally protected. Think of it as having a firewall between your personal life and your business life.

Tax Implications

LLCs offer pass-through taxation, which means the business itself is not taxed. Instead, profits and losses are passed through to the owners, who report them on their personal tax returns. This can result in significant tax savings compared to corporations, which face double taxation.

Flexibility and Simplicity

LLCs provide a great deal of flexibility in management and operations. You can choose how your LLC is managed—by members (owners) or by managers. Additionally, LLCs have fewer formalities compared to corporations, making them easier to manage.

Steps to Form an LLC

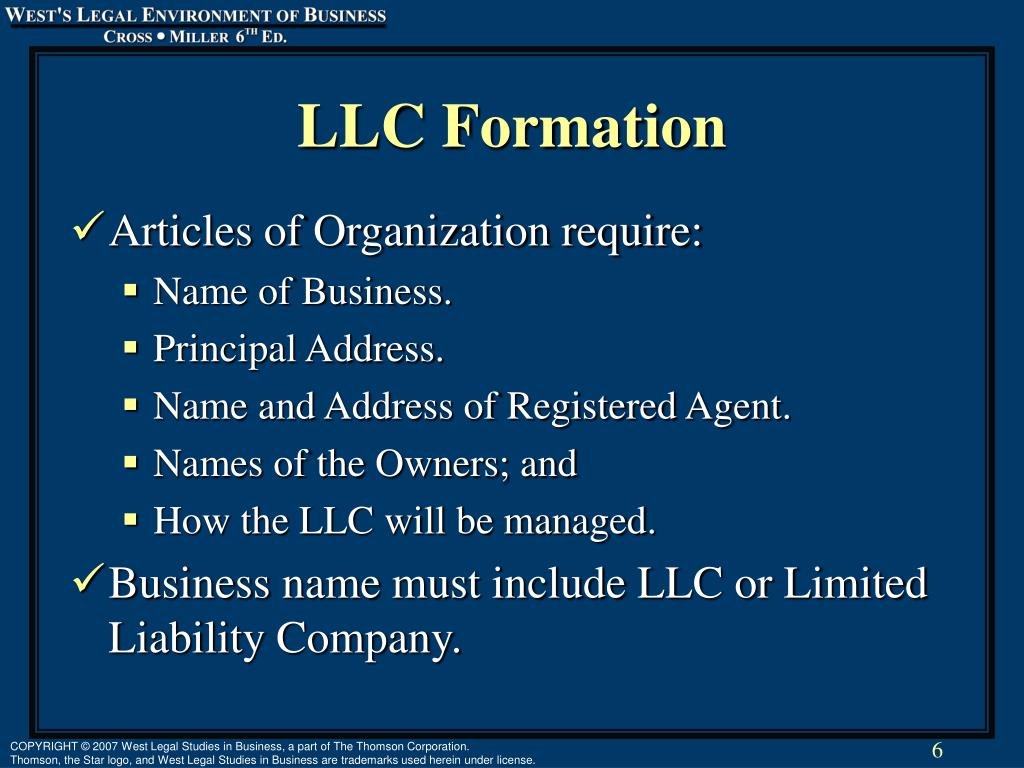

1. Choose a Name

Your LLC's name must be unique and comply with your state's naming requirements. It should end with "LLC," "L.L.C.," or "Limited Liability Company."

2. Appoint a Registered Agent

A registered agent is a person or entity that receives legal documents on behalf of your LLC. This can be you, a trusted individual, or a professional service.

3. File Articles of Organization

This document officially creates your LLC. It includes basic information about your business, such as its name, purpose, and management structure.

4. Create an Operating Agreement

While not required in all states, an operating agreement outlines the functional and financial decisions of your LLC, including roles, structural aspects, and financial and functional decisions.

5. Obtain an EIN

An Employer Identification Number (EIN) is required for tax purposes. You can obtain one from the IRS.

6. Open a Business Bank Account

Separating your personal and business finances is crucial for maintaining liability protection. Open a dedicated business bank account for your LLC.

Comparing LLCs to Other Business Structures

LLC vs. Sole Proprietorship

- Liability: LLCs offer limited liability protection, while sole proprietorships do not.

- Taxes: LLCs can choose pass-through taxation, whereas sole proprietorships are taxed as individuals.

- Formalities: LLCs have more formalities but offer better protection.

LLC vs. Corporation

- Liability: Both offer liability protection, but LLCs have fewer formalities.

- Taxes: Corporations face double taxation, while LLCs have pass-through taxation.

- Management: LLCs offer more flexibility in management.

Conclusion

Choosing the right business structure is a pivotal decision that can shape the future of your enterprise. Whether you opt for an LLC, sole proprietorship, partnership, or corporation, understanding the pros and cons of each will help you make an informed choice. LLCs, in particular, offer a compelling blend of liability protection, tax advantages, and operational flexibility.

Remember, the best structure for your business depends on your unique needs and goals. Consulting with a legal or financial advisor can provide tailored advice to ensure you're on the right track.

Are you ready to take the next step in your entrepreneurial journey? Choose the right business structure, and watch your business thrive!

FAQs

What is the main advantage of forming an LLC?

- The main advantage of forming an LLC is the limited liability protection it offers, which separates your personal assets from your business assets.

How do LLCs differ from corporations in terms of taxation?

- LLCs offer pass-through taxation, meaning profits and losses are reported on the owners' personal tax returns. Corporations, on the other hand, face double taxation, where the corporation is taxed first, and then shareholders are taxed on their dividends.

What is a registered agent, and why do I need one for my LLC?

- A registered agent is a person or entity that receives legal documents on behalf of your LLC. Having a registered agent ensures that your LLC remains in compliance with state laws and can receive important legal notices.

Can I change my business structure later?

- Yes, you can change your business structure later, but it involves a process called conversion. This can be complex and may require legal and financial guidance to ensure compliance with all regulations.

What is the role of an operating agreement in an LLC?

- An operating agreement outlines the functional and financial decisions of your LLC, including roles, structural aspects, and financial and functional decisions. While not required in all states, it is highly recommended to have one to avoid disputes and ensure smooth operations.

Posting Komentar