Starting a business is like embarking on a thrilling adventure. You have a vision, a dream, and a plan. But just like any great adventure, you need the right resources to make it a success. One of the most critical resources is funding. Finding business investors for your startup can be a daunting task, but with the right strategy and approach, you can attract the capital you need to turn your dream into reality.

Understanding Startup Funding

Before diving into the specifics of how to find business investors, it's essential to understand the landscape of startup funding. Startup funding can come from various sources, including venture capital, angel investors, and even crowdfunding. Each source has its own set of advantages and challenges.

Venture Capital

Venture capital firms are professional investment companies that manage funds on behalf of others. They typically invest in high-growth, high-risk startups in exchange for equity. Venture capital can provide significant financial backing, but it often comes with strings attached, such as board seats and influence over business decisions.

Angel Investors

Angel investors are high net worth individuals who invest their personal funds in startups. Unlike venture capitalists, angel investors often provide more than just money; they can offer mentorship, industry connections, and valuable advice. However, they may also expect a higher return on investment and a more hands-on role in the company.

Crowdfunding

Crowdfunding platforms allow startups to raise funds from a large number of people, typically through small contributions. This method can be an excellent way to validate your product and build a community around your brand. However, it requires a compelling pitch and a strong marketing strategy to attract enough backers.

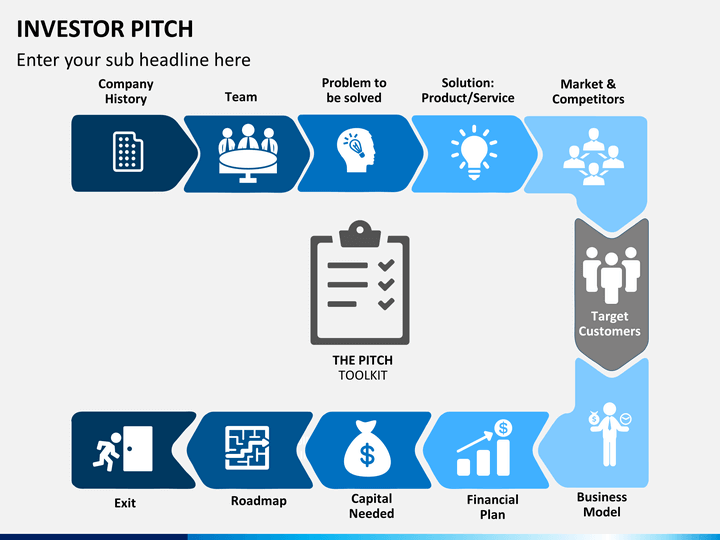

Crafting an Investor Pitch

Once you understand the different types of investors, the next step is to craft a compelling investor pitch. Your pitch should be concise, engaging, and tailored to the specific investor you are approaching. Here are some key elements to include in your pitch:

The Problem

Start by clearly defining the problem your startup is solving. Investors want to know that there is a real need for your product or service. Use data, statistics, and real-life examples to illustrate the problem.

The Solution

Next, explain how your startup solves the problem. Describe your product or service in detail, highlighting its unique features and benefits. Use visuals and demonstrations to make your solution come to life.

The Market

Provide an overview of the market you are targeting. Include market size, growth potential, and competitive landscape. Investors want to see that there is a significant opportunity for your startup to succeed.

The Business Model

Explain how your startup will generate revenue. Describe your pricing strategy, customer acquisition costs, and revenue projections. Investors need to understand how your business will make money.

The Team

Introduce your team and highlight their relevant experience and expertise. Investors often invest in people as much as they invest in ideas. Show that you have a strong, capable team that can execute your vision.

The Ask

Finally, clearly state what you are asking for. Specify the amount of funding you need, how you plan to use it, and what you are offering in return. Be realistic and transparent about your financial needs.

Building a Strong Business Network

Networking is a crucial part of finding business investors. Building a strong business network can open doors to potential investors, mentors, and partners. Here are some tips for effective business networking:

Attend Industry Events

Industry events, conferences, and trade shows are excellent opportunities to meet potential investors and industry experts. Make sure to research the events that are relevant to your startup and plan your attendance strategically.

Join Online Communities

Online communities and forums can be a valuable resource for connecting with investors and other entrepreneurs. Platforms like LinkedIn, Reddit, and Quora have active communities where you can engage in discussions and share your startup's story.

Leverage Your Existing Network

Don't overlook the power of your existing network. Reach out to friends, family, colleagues, and alumni who might have connections to potential investors. Ask for introductions and referrals.

Follow Up

After meeting potential investors, make sure to follow up promptly. Send a thank-you note or email, and keep them updated on your startup's progress. Building a relationship takes time and effort, so be persistent but not pushy.

Preparing for Investor Meetings

Once you have identified potential investors and crafted your pitch, the next step is to prepare for investor meetings. These meetings are your chance to make a strong impression and secure the funding you need. Here are some tips for successful investor meetings:

Research the Investor

Before the meeting, research the investor thoroughly. Understand their investment philosophy, portfolio, and past investments. Tailor your pitch to their interests and preferences.

Practice Your Pitch

Practice your pitch until you can deliver it confidently and smoothly. Anticipate questions and prepare thoughtful answers. The more prepared you are, the more confident you will feel.

Bring Supporting Materials

Bring any supporting materials that can enhance your pitch, such as a demo, prototype, or financial projections. Visual aids can help investors understand your startup better.

Be Honest and Transparent

Investors appreciate honesty and transparency. Be open about your startup's strengths and weaknesses. Address any potential concerns upfront and provide realistic expectations.

Follow Up

After the meeting, follow up with a thank-you note or email. Summarize the key points discussed and reiterate your interest in working together. Keep the lines of communication open and be responsive to any follow-up questions.

Conclusion

Finding business investors for your startup is a challenging but rewarding process. By understanding the different types of investors, crafting a compelling pitch, building a strong network, and preparing for investor meetings, you can increase your chances of securing the funding you need. Remember, the journey to success is not always smooth, but with perseverance and the right strategy, you can turn your startup dream into a reality.

FAQs

What is the difference between venture capital and angel investors?

- Venture capital firms manage funds on behalf of others and typically invest in high-growth, high-risk startups. Angel investors are high net worth individuals who invest their personal funds in startups and often provide mentorship and industry connections.

How do I craft a compelling investor pitch?

- A compelling investor pitch should clearly define the problem your startup is solving, explain your solution, provide an overview of the market, describe your business model, introduce your team, and clearly state your funding needs.

What are some effective ways to build a business network?

- Effective ways to build a business network include attending industry events, joining online communities, leveraging your existing network, and following up with potential investors.

How should I prepare for investor meetings?

- To prepare for investor meetings, research the investor thoroughly, practice your pitch, bring supporting materials, be honest and transparent, and follow up after the meeting.

What should I do if I don't secure funding from an investor?

- If you don't secure funding from an investor, stay persistent and continue to refine your pitch and business plan. Seek feedback from the investor and use it to improve your approach. Keep building your network and exploring other funding options.

Posting Komentar